It was generally perceived that Earthquake risk in the US could be limited to particular areas of the country, the areas we all know, being the New Madrid basin, the Pacific Northwest and possibly most famously, California. But this was when the only risk we were aware of was the naturally occurring earthquakes.

Over recent years, there has been a dramatic increase in fracking and the disposal of waste water in the states of Texas and Oklahoma which has resulted in an increase of Earthquake activity. Whilst deemed to be man made and with magnitudes of only 3.5 or less, it is still a risk that has prompted applications for these processes to be postponed or shut down completely over fear from local communities of the higher frequency of quakes and the damage they could cause.

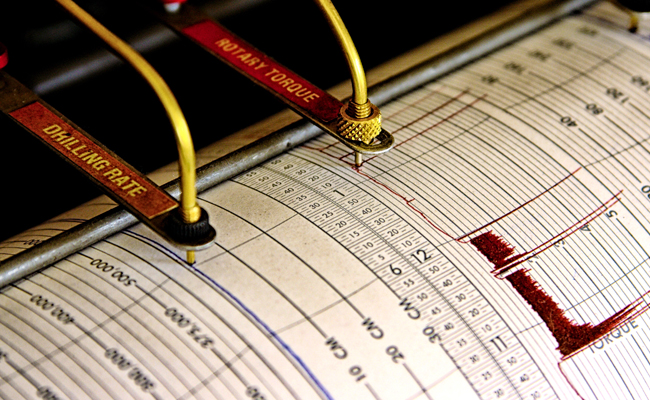

The increase in risk of induced earthquakes actually resulted in the USGS preparing a forecast for damage from both Natural and Induced Earthquakes for this year, detailed in the map below.

This situation hasn’t gone unnoticed by local businesses either, with Equinox Underwriting seeing an increase in enquiries for Earthquake Insurance in these areas in 2017 compared to 2016.

Whilst this new area of risk continues to grow and cause more uncertainty in the occurrence of Earthquakes, the threat of a naturally occurring quake also keeps threatening with increases in acitivty in Alaska, Calfornia and most recently, Hawaii. Whilst California’s activity has been fairly weak with magnitudes in the range of 2.5 to 3.5, Alaska and Hawaii have seen activity of over 5.0 with potential for damage if in highly populated areas.

But we cannot dismiss the threat in California. The notorious San Andreas fault extends around 800 miles through California and has a varying degree of risk throughout with the highest risk being a segment around 35 miles south of Los Angeles. With the average period between quakes on this fault line being 100 years, and the last quake occurring in 1857, we are already 60 years over the average.

Whilst the threat and type of earthquake risks are changing and the areas at risk growing, the need for coverage against this peril remains as important as ever.